Now that year 2023 is in hindsight, it may be worth taking a look at the market performance, and see if there are any lessons for the average investor. ‘Investing luck’ essentially boils down to two key things: timing and picking the winners. The two have been an elusive holy grail of investors ever since the first stock exchange opened in 1600s. But in 2023, an index investor still would have made an impressive 26% in S&P-500 (dividends included). That’s not bad – given the interest rate climate and overall gloomy economic situation.

But.. the timing was crucial

As seen above, while the year ended with a great cheer, those who missed the December rally would be sitting on a mediocre sub-2% returns p.a. Positive announcements from the U.S. Fed prompted a sharp surge in markets in the last month, and a few news outlets even screamed ‘Christmas came early!‘. But realistically speaking, how many average investors really participated in this upswing? Not a lot. In a tense sentiment around ‘cancelled recession‘ many shifted from equities into bonds.. right before the rally! Risk appetite being constant, this money found its way into riskier, low-grade bonds. Unsurprisingly, sell-volume in major stock indices was higher than normal in November ’23.

Lesson here is simple – if you missed out December, it’s very likely you underperformed the index in 2023. That’s 11/12 chance for someone who actively churns their portfolio every month.

and picking winners? Less than 3/10 chance

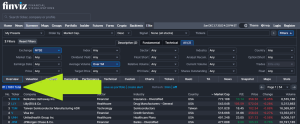

Now let’s look at how many stocks actually gave ‘better than index’ returns. Here, it’s best to filter out penny stocks or very illiquid small-caps, because their prices can fluctuate a lot. We will keep our ‘stocks universe’ limited to the ones with over 1M avg. daily volume. After all, liquidity is key.

Image Credits – FinViz.com

Out of 1061 NYSE traded liquid stocks, only 295 gave an index beating performance. That’s less than 3/10 chance of picking a winner. Now look carefully at the #1 alpha stock. I’d bet, before 2023, ‘Eli Lilly’ would have been off-radar of most average investors. The company had so-so coverage by stock analysts. But the hype around its new, breakthrough drug pushed it to the top of the charts!

Interestingly, not even Warren Buffet’s Berkshire Hathaway could beat the index. So, what are the chances of us average Joes?

Conclusion

Year 2023 has repeated the same, age-old investing axioms:

- Time in market beats timing the market.

- Don’t look for the needle in the haystack. Just buy the haystack.