Hey, your portfolio needs to see a doctor!

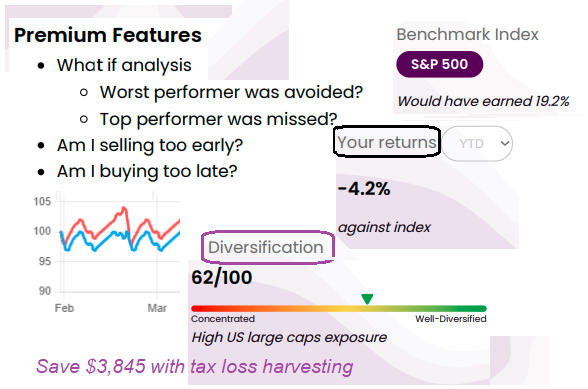

Analyze your trading psychology and impulses.

See how you did against passive index investing.

Don't just trade, rebalance and optimize your investments.

We offer you a more truthful insight on your trading behavior. We do this by correctly benchmarking your portfolio, considering opportunity cost (cash interest), capital gains tax, brokerage fees, dividends, and all real-life scenarios.

Truly Global

Depending on your geography and risk profile, benchmark with any index of your choice, e.g. 60:40 index or even any ETF from any exchange.

Add cash, bonds, stocks in any currency!

All at once glance

Consolidate all your investments across brokers, bank accounts, with different currencies, commodities, crypto … ANYTHING!

Get the complete picture, not just one account.

Actionable insights

Instantly see how you can manage your money better, and the corrective actions you need to take.

Much more besides just tax loss harvesting.

How it works

Enter trades

Just import your trades from a brokerage account, or add them manually. We compute your portfolio’s NAV, including the cash component.

Set the benchmark

We plot your portfolio’s NAV over a timeline, and benchmark it against a chosen index

Get insights

We show you, how you need to optimize your portfolio and tweak your trading behavior

Our Mission

We want to put an end to active portfolio churn

Enormous ‘research’ time and effort is spent by millions of retail investors (traders ?) worldwide. Yet, a very few can manage to beat the index. Portfolio doctor shows you, in plain sight, that passive index investing offers:

- better returns

- and/or lesser volatility

- and/or better diversification of risks

- and, definitely more peace of mind!

Why passive investing?

Typically most retail investors start with a discount brokerage account and trade by themselves. Some go for actively managed funds. Very quickly, they are disappointed by actual gains (if any) after taxes, fees, etc. Instead, a low-cost index solution offers –

More safety

Index solutions are less prone to malpractices, kick backs and other operational risks of active investment products

Less volatility

Most high performing stocks are also high-beta. That means, they’re more volatile and/or they perform worse than the index

More Diversification

People and active fund managers are often heavily biased towards certain sector or geography

our fees

What's peace of mind worth to you?

Our mission is to get you an ‘auto-pilot’ portfolio for the long-term. Ideally, you’d need to rebalance your portfolio no more than once a quarter. That is why, we only have 3 month plans. We’re in beta and wish to collect user feedback. All our plans are free to use and all software is intentionally open source!

Free trial

$ 0

6 major currencies, 6 major equity indices for benchmarking

Enter up to 20 trades, from 5 year ago

Personal plan

$ 0

150+ currencies, select any Index / ETF for benchmarking

Import trades from Excel or directly from most popular brokers. Import up to 100 trades, from 20 years ago.

Advisor plan

$ 0

everything offered in the personal plan, and..

Save and manage up to 100 client portfolios. Wow your clients with simulations and analytics

Our clients have something to say

but don’t take their word for it. Try out our free plan today!

Testimonials

Faqs

Questions we know, you have on your mind

After months and years of trading, you want to take a breather and analyze your portfolio's performance. Specifically, you're interested in a few 'What-If' scenarios, primarily index investing, to see what the results would have been.

The tool is useful for anyone who spends 'significant' time and mental energy in investing in stocks. 'Significant' is relative, but let's say, if you can't resist checking stock prices everyday, then this tool may help you save a lot of time and money.

Not if you take a corrective action from it. The purpose of benchmarking against an Index and running a few 'what-if's is to gain insights from your trading behavior, and turn the beneficial 'What-If's into actual action.

The reports from brokers/banks often only show you your portfolio's NAV returns. They miss out on crucial factors like your idle cash, returns gained/missed from it, transaction fees or capital gains tax. Also, their incentives are skewed towards your frequent trading; not returns; Certainly not a passive solution - even if it usually performs much better.

No. All we suggest is, you see for yourself whether your trading has outperformed the simple buy-and-hold index strategy. Even if you choose to actively trade, you can still get insights on your trading behavior and see how you can do better.

Quite simply, it means your total liquid wealth: including the tradable instruments and the cash that you'd have needed to fund your trades. More on this..

In many countries, the profits from trading are taxed; and can be offset against any losses incurred in the same financial year. Tax loss harvesting means selling a part of your portfolio at a loss close to the end of a financial year, with the intention of reducing your tax burden.

That's because it's a plot of your total assets: Cash and tradeable instruments. We use the concept of 'Cash aware' portfolio, where cash required to fund all your trades is taken as the 'net investment', parked in a hypothetical savings account or a liquid ETF. When interest rates are high, this difference will be substantial.

Yes. In discretionary mandate, the trades are invisible to you. But you can still mimic your investing, simply by entering one single trade that's equal to your net investment, in an appropriate index or ETF.